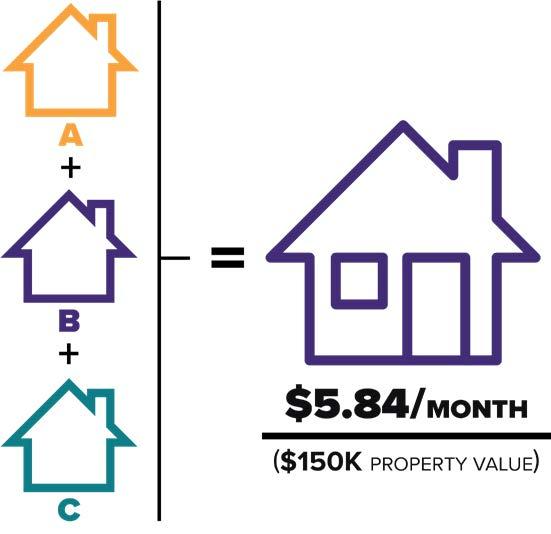

Estimated Impact

If passed, homeowners with the average home value of $150,000 will have an annual decrease in their school district taxes of $538.68 or $44.89 per month due to a recent state compression and a proposed increase to the homestead exemption to $100,000. Homeowners age 65 and older who have applied for and received the Over 65 Exemption will have no increase over their frozen dollar amount with the passage of this bond.

Estimated Impact | Estimated Impact | Estimated Impact |

|---|---|---|

Prop A | Prop B | Prop C |

$3.98 Month | $1.71 Month | $0.15 |